Research published in 2024

Practical implications

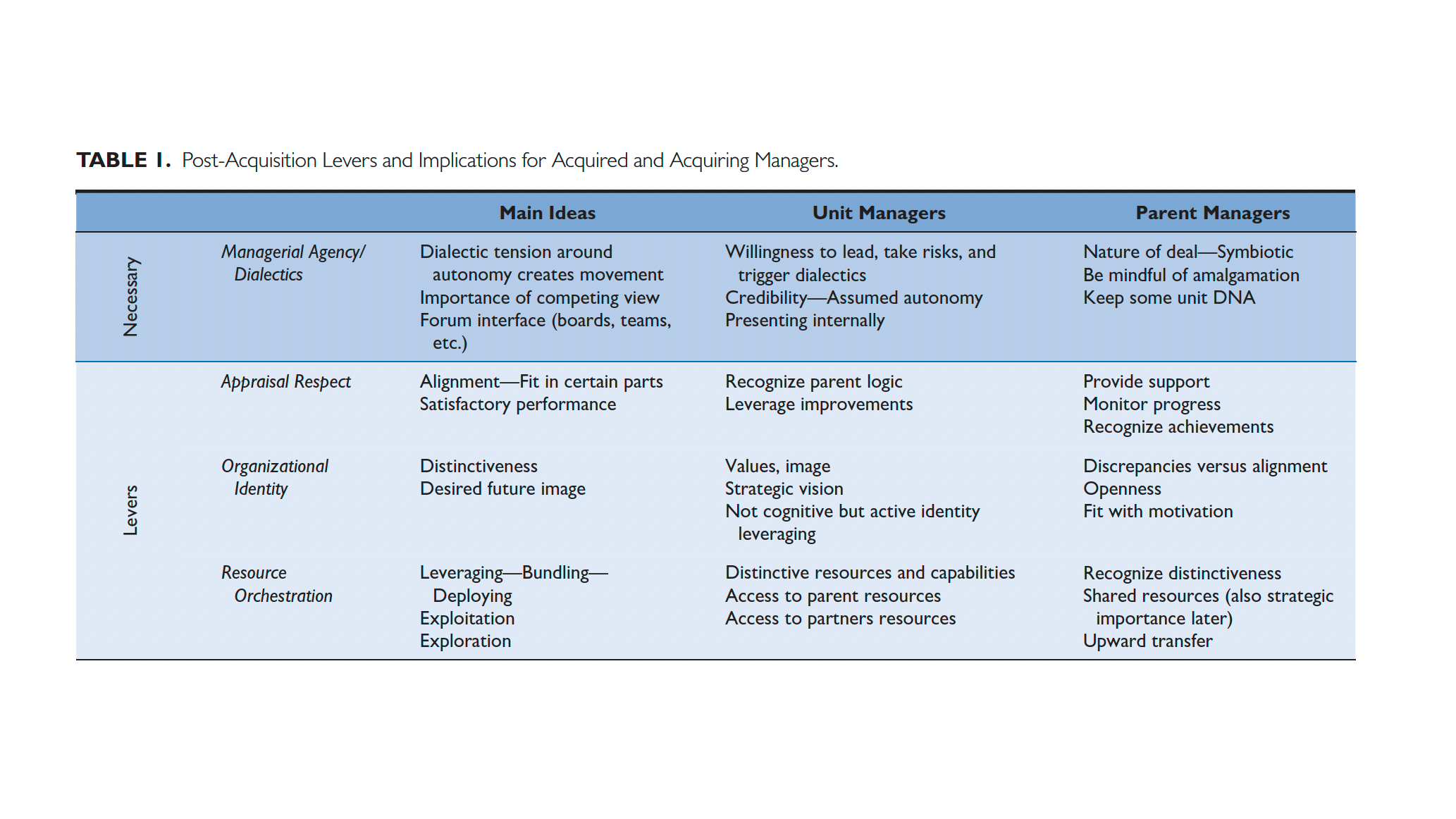

During a post-acquisition integration, managers face a strategic dilemma: On one hand, managers from corporate parents often strive for strategic integration and standardization, in order to synergize corporate processes and resources. Naturally, it is easier to transform internal synergies into cost savings than into market-based gains. Therefore, the default approach favors low organizational autonomy for acquired businesses. On the other hand, the managers of acquired companies frequently seek to maintain or develop a certain level of autonomy so as to retain their organizational identity and successfully manage their competitive environment. We offer a fresh, long-term perspective on how to manage the relationship between a parent and its business unit. Our research shows that organizational autonomy does not need to be fixed, but can instead be fluid and continuously negotiated,

allowing the parent and business unit to achieve sustained integration success.

Abstract

Managing acquired subsidiaries can be daunting. Parent and affiliate executives strive to co-create value, but fixed mindsets around subsidiary autonomy can result in diverging interests and outcomes. Through a longitudinal study of Audi’s postacquisition integration of supercar manufacturer Lamborghini, this article provides guidance on how to manage the level of acquired subsidiary autonomy as a strategic dial that can be dynamically adjusted over time for mutual benefit. This dynamic approach to autonomy rests on three specific managerial levers—appraisal respect, organizational identity, and resource orchestration. These can enable the renewal of competitive capabilities and sustain post-acquisition success.

This research project was conducted in collaboration with:

Thomas Lawton (Cork)

Duncan Angwin (UCL)

Jean-Luc Arrègle (emlyon)

Paolo Barbieri (Bologna)

“Managers can unlock their firms’ potential by dynamically adjusting autonomy over time – like a strategic dial – for the long-term, mutual benefits of the parent and the business unit.”

A dynamic approach is more likely to achieve benefits through a more accurate post-acquisition assessment of capability interaction than relying on a snapshot assessment at the time of the acquisition itself. This more sensitive approach to managing integration over time is likely to more closely approximate optimal performance than a static one-way take-all approach.

Organizational identity is a key driver of the dialectical tension in the parent-unit relationship.

Back to Organizational Autonomy